In today’s global supply chain, few disruptions cause as much uncertainty as sudden tariff changes, especially in industries reliant on complex components like TFT LCD displays. With the U.S. recently re-evaluating and enforcing tariffs on a wide range of Chinese goods, businesses importing flat-panel displays, particularly thin-film transistor liquid crystal displays (TFT LCDs), are facing potential cost hikes, supply chain disruptions, and regulatory complexity.

So what can you do to protect your business?

In this blog, we’ll break down the current situation, how to monitor developments, and most importantly, how to proactively minimize your risk.

📌 Understanding the Current Tariff Landscape

The U.S. has had a layered approach to tariffs on Chinese goods since the start of the U.S.-China trade war in 2018. TFT LCDs have at times been included in tariff lists, with duties ranging from 7.5% to 25% depending on classification.

In 2024 and early 2025, renewed scrutiny over China’s tech exports—especially components seen as key to U.S. industries—has led to potential reinstatement or reclassification of duties under Section 301 of the Trade Act.

Key HS Codes to watch:

- 9013.80.90 – Certain display modules

- 8524.99.50 – LCD panels

- 8471.60.90 – Parts for data processing units including displays

You need to work closely with your customs broker to determine exactly how your products are classified.

🔍 Monitoring Trade Policy and Regulatory Shifts

Tariffs are often politically driven and can change quickly. Here’s how to stay informed:

1. Use Government Sources

- U.S. International Trade Commission (USITC): Check tariff classification and rulings.

- Office of the U.S. Trade Representative (USTR): Regular updates on Section 301 tariff actions.

- Customs and Border Protection (CBP): Stay informed on compliance alerts and rule changes.

2. Sign Up for Trade Alerts

Services like Panjiva, Import Genius, or Flexport newsletters provide tariff tracking and supply chain alerts.

3. Consult Trade Attorneys or Consultants

For high-risk or high-value imports, professional advice is worth the cost. Legal experts can also help file for exclusions or reclassifications.

⚠️ Risk Impacts to Watch

1. Cost Increases

A 25% tariff can decimate already-thin margins on display panels. Without price negotiation or supply adjustments, profit drops quickly.

2. Delayed Shipments

Products flagged for reclassification can be held at port while CBP evaluates compliance, causing downstream delays.

3. Contractual Risk

If your contracts don’t have force majeure or price adjustment clauses for tariff increases, you could be on the hook for extra costs.

✅ Strategies to Minimize Risk

Here’s where you can take action:

1. Review Your Supply Chain

- Can you source panels from Vietnam, Taiwan, or Mexico?

- Are there U.S.-based distributors who already cleared customs?

2. Explore Tariff Engineering

Some companies modify how products are shipped or assembled to qualify for different tariff codes. Example: importing disassembled kits instead of fully assembled modules.

⚠️ Always verify strategies with legal counsel to ensure they comply with CBP regulations.

3. Apply for Exclusions

Section 301 exclusion processes occasionally reopen. If your product has limited alternatives or national security importance, you may qualify.

4. Leverage Foreign Trade Zones (FTZs)

Importers can delay or avoid duties by processing goods within designated FTZs before entering U.S. commerce.

5. Renegotiate Contracts

Build in clauses that share or shift cost responsibility if tariffs spike. A smart contract today can save you headaches later.

🧭 Final Thoughts

The trade landscape isn’t just about politics—it’s about preparedness. Companies that understand the shifting sands of tariff policy, monitor changes proactively, and adapt strategically will be the ones that stay competitive.

Whether you’re importing small volumes of TFT LCDs or rely on them at scale for devices and display technologies, now is the time to assess exposure and act.

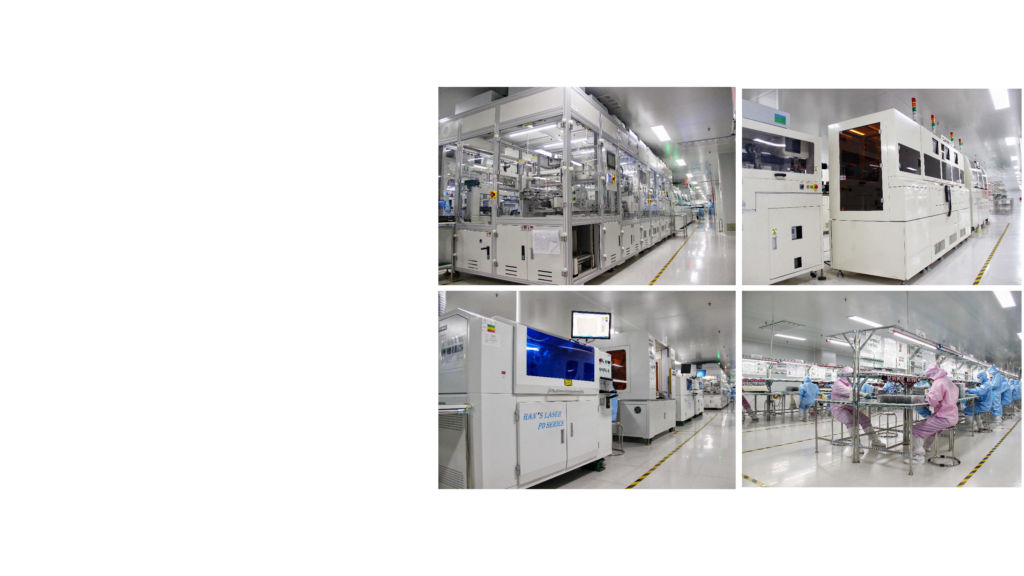

Need help classifying your product or planning alternative sourcing? Reach out—we can help map out your risk and build a resilient import strategy. Microtips Technology https://microtipsusa.com/ is excited to announce our new manufacturing facility in Vietnam! This strategic addition delivers the same high-quality displays you trust, now with the added benefit of a non-China manufacturing option. This move helps you avoid high tariffs while strengthening your supply chain reliability.

By investing in our Vietnam-based facility, we are better positioned to support fast-growing markets and ensure uninterrupted supply, providing stability and continuity for your projects.

Would you like to learn more? Reach out to us at mtusainfo@microtipsusa.com